The Marietta Prospect

Texas

Gulf Coast

Due to the highly proprietary status specific geographic

information will be provided subject to a certain Non-Compete, Non-disclosure Agreement

and imminent to a transaction.

Horizontal Drilling and Fracture Stimulation of a Series of Tight

Oil and Gas Sands:

MPG Petroleum, Inc. has identified a series of stacked,

hydrocarbon bearing sands that have never been produced. Charge has been proven and the hydrocarbon

source rock has been geochemically matched to this series of sands. The

reservoirs contain (unrisked) PUD

reserves of high-gravity (59 API) oil and

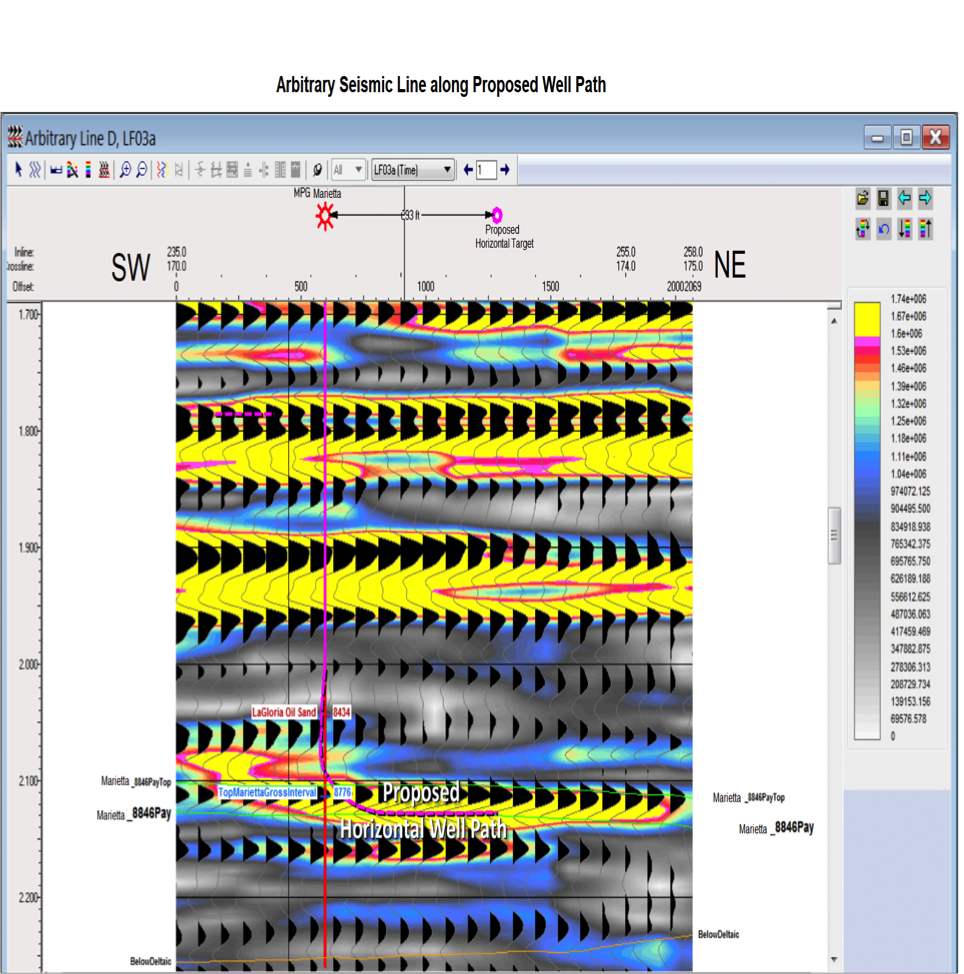

high-Btu (1450) natural gas. Supporting data include Flow Tests, Mud Logs,

Petrophysical Logs and 3D seismic data exhibiting direct hydrocarbon indicators (“DHI’s” aka bright

spots or amplitude anomalies).

Individual amplitude anomalies range in size from 40 to 170 acres

and appear to be Deltaic Crevasse Splay (sand-shale

sequence) deposits with porosity ranging from 15- 22%. The prospective reservoirs

are geopressured below ~8,500 ft, with oil and gas shows present from ~5,750 ft

to 9,350 ft. Several zones were

perforated and flow tested at impressive rates, producing oil, natural gas and

condensate but they did not sustain flow due to low porosity and permeability

inherent to the reservoirs. Permeability was likely further reduced and

sustained flow impeded by formation damage caused by the use of a water-based drilling

mud drilling system. Poor cement isolation is also obvious, created by gas flow

into the well during drilling and cementing operations.

Drilled in 2009 and completed with 5.5”, P-110, 17 lb/ft

casing, the well is shut-in currently at 3600 Psi. It is a good candidate to be

utilized as a Pilot Hole to cost efficiently access the by-passed resources of

the series of tight oil and gas sands.

A Sidetrack Lateral well will be drilled from the Pilot Hole with an

oil-based mud system and landed horizontally in the thickest and largest of the

series of tight oil and gas sands, the “8900 ft Deltaic”. This reservoir carried the strongest

show at 3102 units of gas (Show No. 9). The initial objective of the Marietta

Prospect is to access and produce the PUD reserves in this reservoir, then to maximize

all assets accessible from the Pilot Hole with future Sidetrack Laterals. Horizontal

drilling and sand fracture stimulation of tight oil and gas reservoirs has

proven successful in many other areas but MPG will be first to apply this approach to this specific area and formation.

Robust flow rates and high cumulative recoveries

are expected. Ample infrastructure is

present, creating the conditions necessary for a rapid turnaround from investment to revenue.

Risked Reserves: 965,700

BOE (145

Ac. amplitude anomaly, 36 ft avg. thickness)

Net Valuation at $ 80 Oil: $ 51,591,557 (Net

of Royalty and Tax)

Project Cost: $ 3,980,750 (D&C,

GG&L)

Return on Investment: 13 : 1 (Based

on $80 oil price est. over life of well)

Estimated Proceeds Net/Month: $ 624,766 (Based

on 392 BOEPD, $ 80 oil)

Pay Out Projection: 6.4 Months

Contact: Margaret P.

Graham, President •

MPG Petroleum, Inc. mpgraham@mpgpetroleum.com

8700 Crownhill Blvd., Suite 804, San Antonio, Texas, 78209 * 1-210-822-7770 * www.mpgpetroleum.com