Executive Summary

The Trinity Prospect

Onshore, Texas Gulf Coast

Due to the highly confidential information underpinning the Trinity Prospect, location information is disclosed only to those demonstrating a need to know, imminent to a transaction and subject to a certain Non-compete, Non-disclosure Agreement.

The Trinity Prospect is a 3D Seismic amplitude anomaly supported, conventional, stacked-pay prospect. The potential to recover large reserves of high gravity, sweet crude oil and liquids-rich natural gas appears strong, based on size and thickness of target pays and geochemical analysis of the source rock. Located in close proximity to mature infrastructure and premium markets on the Texas Gulf Coast, the Trinity Prospect presents the opportunity for a high return on investment.

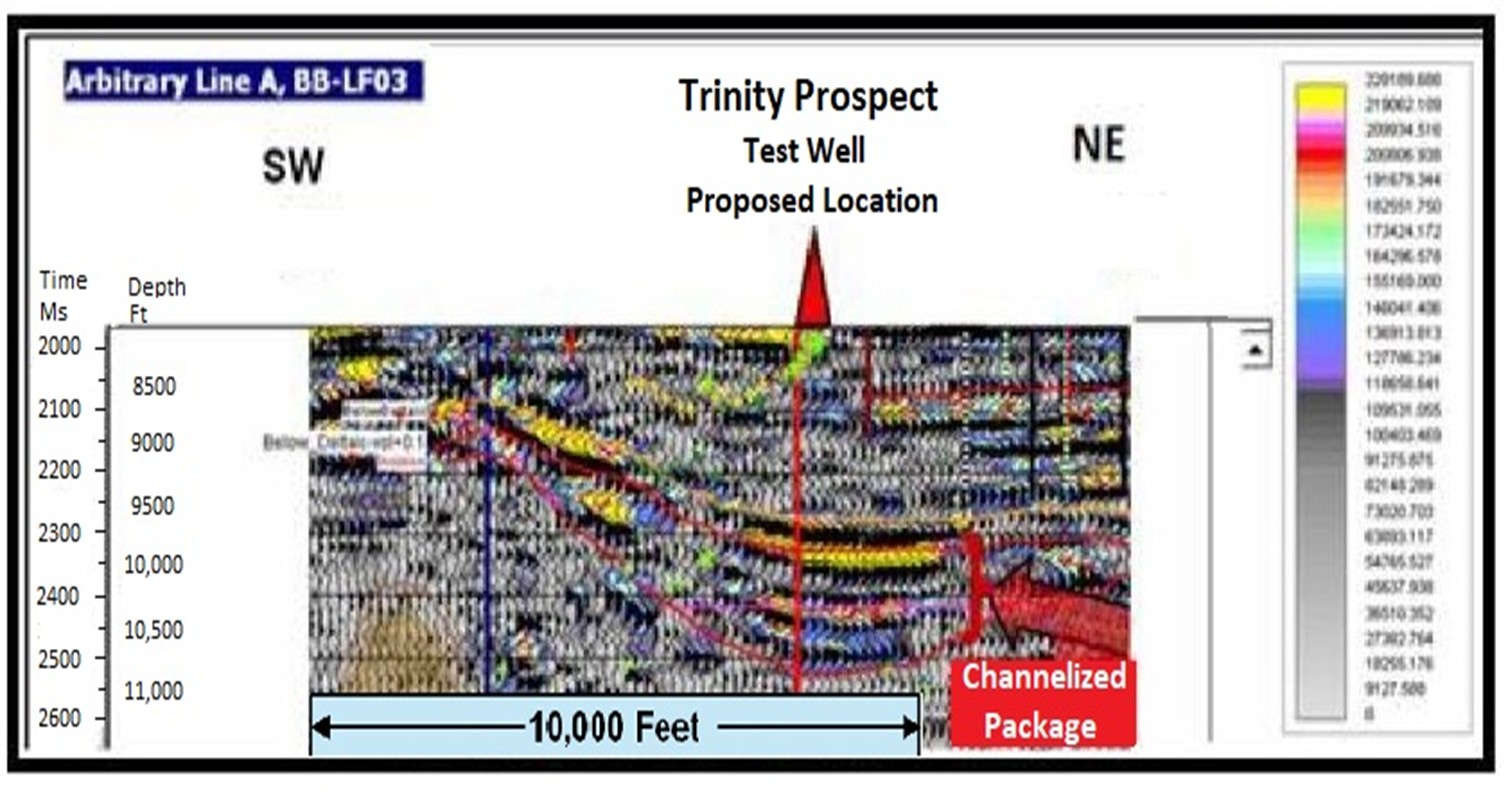

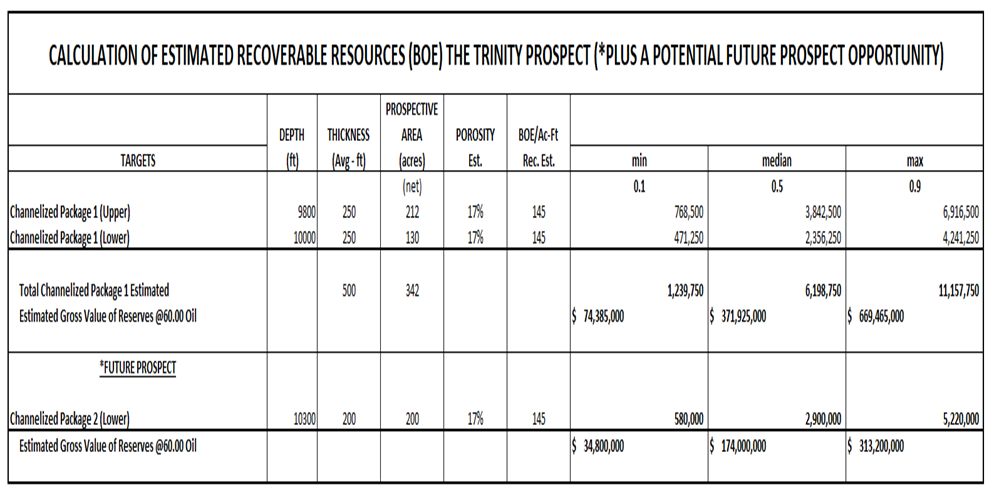

Geological Overview:The largest amplitude anomaly of the Trinity Prospect is the “Upper Target” of the Channelized Package which covers ~212 Acres. The Lower Target covers ~130 Acres. A third potential Pay Target is present but with weaker amplitude. The cut and fill (submarine) Channelized Package is a stratigraphic trap with structural conformance. It is fault bound on the west and east. Its gross thickness is ~ 1160 feet, with net thickness of the Upper and Lower Targets estimated at ~250 feet. The Trinity Prospect is similar to the deepwater, submarine Channel deposits found Offshorebut is located Onshore and is therefore accessible at a fraction of the costand turnaround time from discovery to production. The Test Well will be drilled to a vertical depth of 11,135 feet.

Projected Cash Flow to 100% Working Interest Before Payout: Assumes Initial Flow Rate = 2100 BOEPD, $ 60 Oil flatlined. Definitions: BOEPD = Barrel of Oil Equivalent /Day; NRI = Net Revenue Interest (net of Royalty and ORRI Interest), fixed at 70%; ST = State Tax / Ad valorem tax on Oil fixed at 4.6%; LOE = Lease Operating Expense assumed at $ 40000/Mo; BIAPO = Back In After Payout interest earned by MPG, fixed at 25% WI; ROI = Return on Investment; D&C = Drilling and Completion Cost

2100 BOEPD x 30 Days x $ 60 Bbl x 70% NRI x .954 ST = $ 2,524,284 – $ 40,000 LOE =$ 2,484,284 Net per Month

After Payout Monthly Projected Cash Flow to 100% WI = $ 2,484,284 x .75 = $ 1,863,213

Projected Payout to 100% Cost of Test Well: $ 7,758,951D&C Cost / $ 2,484,284 Net per Mo. = 3 Months to Payout

Projected Recoverable Resources Assuming Mid Case Estimate: 6,198,750 BOE

*Barrels required to produce payout (net of royalty) = 184,922 BBLS

Projected Value of Reserves in USD: (Assumes $60 Oil, Mid Case Recovery, Net includes ST, NRI & BIAPO Interest to MPG)

Gross: $ 371,925,000 Net: $ 186,278,636

Full Project Development ROI : (D& C Cost of Initial Test Well $ 7,758,951, plus 2 assumed Development Wells est. @ $ 4 M each to be paid for out of cash flow)

$ 186,278,636 Net Reserve Valve / $ 15,758,951 Est. Full Project Dev. Cost = 12:1 ROI

Terms: Upfront Drilling Cost of Initial Test Well = $ 57,812 per 1% Working Interest; Test Well Completion Cost = $ 19,777 per 1% WI (to be collected at Casing Point); Total D&C Cost = $ 77,589 per 1% WI. 70% Net to Investor before payout, 52.5% Net to Investor After Payout; 270 Subject Acres; MPG Operates; Private JV, Subject to Prior Sale, withdrawal or change in termsprior to contract.

Contact:Margaret P. Graham, PresidentMPG Petroleum, Inc. – mpgraham@mpgpetroleum.com

8700 Crownhill Blvd., Suite 804, San Antonio, Texas, 78209* 1-210-822-7770* www.mpgpetroleum.com

The Trinity Prospect

A classic cut and fill (submarine) Channel Deposit

*Barrels required to produce payout (net of royalty) = 184,922 BBLS

Calculation of Net Monthly Proceeds and Time to Payout at Varied Oil Prices | ||

Oil Price $/Bbl. | Net Monthly Proceeds | Months to Payout |

| 40 | $ 1,642,856.00 | 4.7 |

| 50 | $ 2,063,570.00 | 3.8 |

| 60 | $ 2,484,284.00 | 3.1 |

| 70 | $ 2,904,998.00 | 2.7 |

| 80 | $ 3,325,712.00 | 2.3 |

| 90 | $ 3,746,426.00 | 2.1 |

| 100 | $ 4,167,140.00 | 1.9 |

| 110 | $ 4,587,854.00 | 1.7 |

| 120 | $ 5,008,568.00 | 1.5 |

Calculation of Net Monthly Proceeds and Time to Payout at Varied Oil Prices | ||

Oil Price $/Bbl. | Net Monthly Proceeds | Months to Payout |

| 40 | $ 1,642,856.00 | 4.7 |

| 50 | $ 2,063,570.00 | 3.8 |

| 60 | $ 2,484,284.00 | 3.1 |

| 70 | $ 2,904,998.00 | 2.7 |

| 80 | $ 3,325,712.00 | 2.3 |

| 90 | $ 3,746,426.00 | 2.1 |

| 100 | $ 4,167,140.00 | 1.9 |

| 110 | $ 4,587,854.00 | 1.7 |

| 120 | $ 5,008,568.00 | 1.5 |